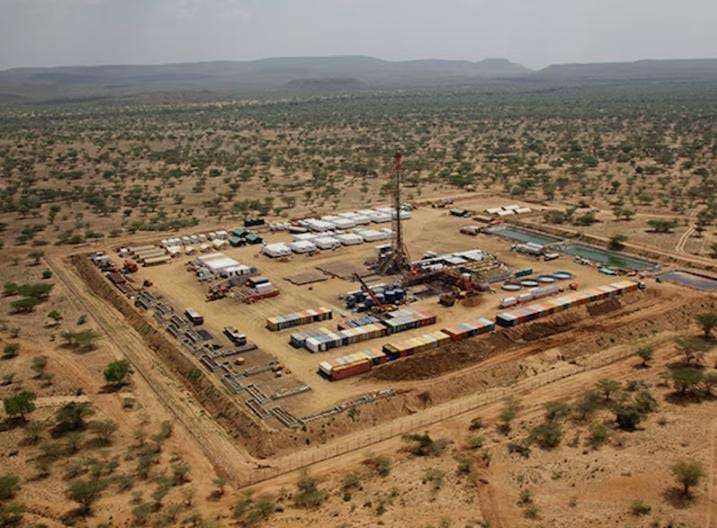

South Lokichar Oil Project, Amosing, Ngamia and Twiga fields. Photo/ Courtesy.

The Government of Kenya has signed a major addendum to the Production Sharing Contract (PSC) governing oil exploration and production in Block T7 formerly Block 13T marking one of the most significant updates to the country’s petroleum framework in recent years.

The addendum, signed in November 2025, brings Gulf Energy E&P B.V. onboard as the full-interest contractor after a complex series of ownership transfers spanning over a decade.

The revised contract aligns the PSC with Kenya’s reconstituted petroleum block map, updated fiscal terms, and the regulatory changes introduced under the Petroleum Act (Cap. 308).

A Long Chain of Ownership Transitions

Block T7 has undergone one of the longest and most intricate chains of assignments in Kenya’s upstream sector.

The block’s journey began in 2008, when the government signed the original PSC with Platform Resources Inc. Subsequent years saw transfers to Africa Oil Kenya B.V., Tullow Kenya B.V., Maersk K3, TotalEnergies entities, and eventually to Gulf Energy following an approved change of control in April 2025.

The addendum acknowledges this history, noting that “Tullow changed its name in the Netherlands to Gulf Energy E&P B.V.” following the acquisition of Tullow’s Kenyan assets by Auron Energy, a special-purpose vehicle of Gulf Energy.

Field Development Plan Already Approved

One of the most notable developments preceding the addendum is the submission of a joint Field Development Plan (FDP) covering discoveries in both Block T6 and Block T7.

ALSO READ: Gulf Energy to Begin Oil Production in Kenya by 2026 After Regulatory Approval

EPRA reviewed and forwarded the FDP to the Cabinet Secretary, who approved it on 5 November 2025, stating that the plan will be tabled in Parliament for ratification as required by law.

According to the addendum “EPRA forwarded the FDP to the Cabinet Secretary with advisory and recommendation for its approval pursuant to Sections 10(1) and 30(4) of the Petroleum Act (Cap. 308).”

Major Fiscal and Operational Changes

The addendum introduces several key amendments that are expected to reshape project economics and government revenues:

Increased Cost Recovery Ceiling

The cost recovery limit rises from 65 percent to 85 percent, allowing the contractor to recoup a larger share of expenses before profit oil is split. The document states: “The contractor shall recover… a maximum of eighty-five percent (85 percent) per fiscal year of all crude oil produced and saved.”

This revision reflects the high costs associated with development and production in Turkana and aims to improve project viability.

Updated Government Participation Rights

Government participation through National Oil Corporation of Kenya (NOCK) increases from 15 percent to 20 percent, strengthening Kenya’s interest in the project.

New Tax Exemptions for the Contractor

A new clause grants the contractor and subcontractors exemptions from VAT, withholding tax on petroleum-related services, and import levies for petroleum operations.

The addendum states that they shall be exempt from: “value added tax on goods and services… railway development levy and import declaration fee… and withholding tax on services and on interest on loans.”

This is consistent with investment incentives offered in other frontier petroleum markets.

Crude Oil Lifting and Transportation Changes

All crude from Block T7 will now be lifted from Turkana but transported to Mombasa for marketing. The revised clause states that “all crude oil… shall be lifted by the Contractor to Mombasa for marketing by the Contractor on terms to be agreed by the Parties.”

This aligns with Kenya’s plan to optimize the Lokichar Mombasa export corridor.

Alignment With New Petroleum Laws.

Kenya’s Petroleum Act contains a stabilisation clause protecting existing contracts from retroactive fiscal or legal changes. The addendum reinforces this by adding a new provision that “any amendment, repeal or enactment of laws… shall not apply retroactively to alter, diminish, or impair the rights, privileges and obligations under this contract.”

This is expected to boost investor confidence at a time when Kenya is pushing to revive its stalled early oil development agenda.

A Strategic Move for Kenya’s Oil Future

The signing of the addendum signals renewed momentum for Kenya’s long-delayed oil development project in Turkana.

With Gulf Energy now in full control of Block T7 and the FDP approved the government is positioning the Lokichar basin for commercialisation after years of uncertainty.

The updated terms aim to balance investor incentives with enhanced state participation, potentially unlocking billions in investment needed to build full field production facilities and the long-awaited crude export pipeline.