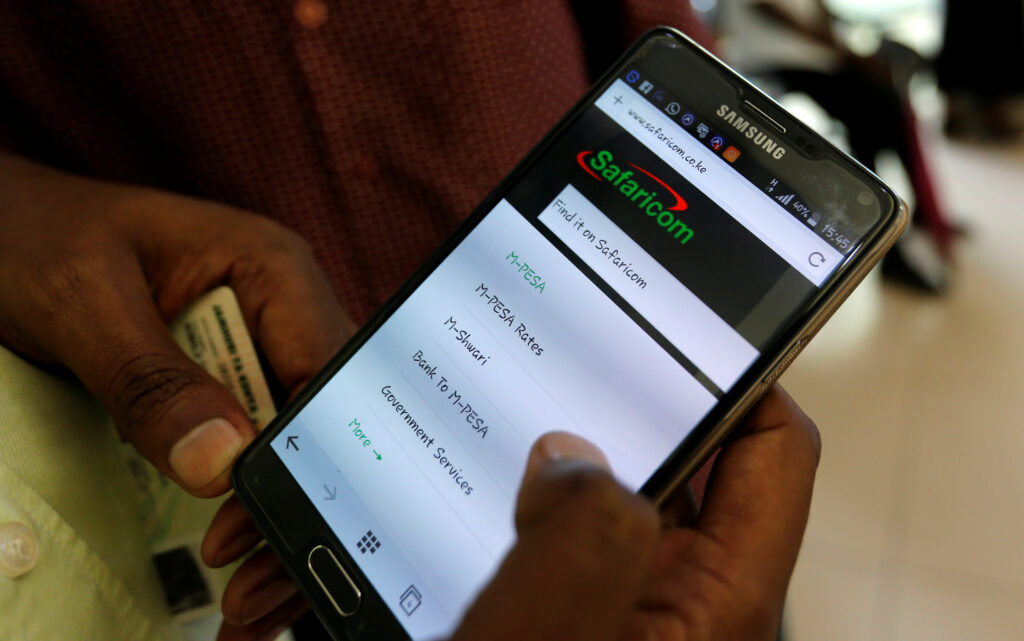

An employee assists a customer to set-up M-Pesa money transfer servive on his handset inside a mobile phone care centre operated by Kenyan's telecom operator Safaricom; in the central business district of Kenya's capital Nairobi, May 11, 2016. REUTERS/Thomas Mukoya - RTX2DU5V

The Central Bank of Kenya (CBK) now wants to significantly reduce Mpesa and Airtel Money transaction fees.

According to CBK’s latest National Financial Inclusion Strategy, the lender says the high transaction costs have led to reduced growth in mobile money usage. It also said that most Kenyans use Mpesa and Airtel Money mainly for person-to-person transfers and avoid services like insurance and savings.

The CBK wants to reduce the average cost of transactions from Sh23 to Sh10 by 2028 and cap charges for person-to-person transfers.

Currently, Safaricom charges Sh7 for transfers between Sh101 and Sh500, and Sh108 for transfers between Sh50,000 and Sh250,000. However, sending Sh100 and below is free.

ALSO READ: Why Commercial Banks Wants CBK to Cut Base Rate

On the other hand, money transfers between Airtel Money customers are free, but the company charges Sh6 for transfers between Sh101 and Sh500, and Sh105 for transfers between Sh50,000 and Sh250,000 to other networks.

The CBK pointed out, among other things, that limited interoperability, low financial literacy, high transaction fees, and poor product design do not meet the needs of underserved people, especially within the banked population.

For this proposal to be implemented, it requires approval from Parliament.

If the proposal gets the nod in Parliament, it will be a relief to Kenyans but bad news for telcos whose profits rely heavily on transfer charges.

Since its inception in 2007, mobile money has been the backbone of the economy as money transfers were reduced to a few clicks compared to bank transfers that required individuals to visit branches or agents.