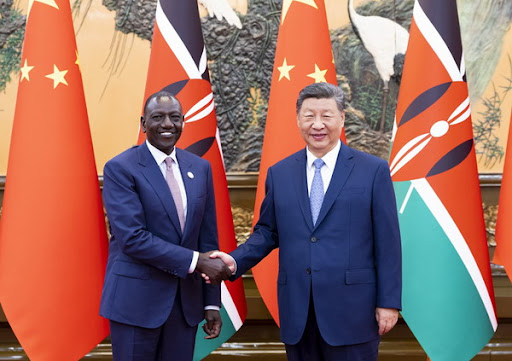

President William Ruto and his Chinese counterpart XI Jinpin. Photo | courtesy.

Kenya is negotiating with China to convert dollar-denominated loans into Yuan and extend repayment periods in a move aimed at cutting its $1 billion (Sh129 billion) annual debt service costs, Treasury Secretary John Mbadi has said.

The talks, focused on financing for the $5 billion (Sh645 billion) Standard Gauge Railway (SGR), are intended to create more budget flexibility and reduce interest charges, Mbadi said in an interview on Wednesday.

“The moment we move from US dollar to Renminbi, automatically, the interest rate reduces by almost half,” he said. “To us, that is a big saving.”

He added that adjusting the tenor of the loan would also provide relief to the country.

Kenya, which the International Monetary Fund (IMF) classifies as being at high risk of debt distress, has been under pressure since 2024 when anti-government protests forced President William Ruto’s administration to abandon tax measures.

ALSO READ: ViFi Labs Acquires Uganda’s OneRamp to Boost Stablecoin Payments Across Africa

Payments on loans from the Export-Import Bank of China are estimated to account for about a quarter of total external debt repayments in the fiscal year through June 2025, according to a parliamentary report.

Kenya’s public finances are strained by underperforming revenue collection, piling loan repayments, arrears to suppliers and expenditure carryovers from previous years, the Treasury said.

“That’s because of some decisions that were taken on huge infrastructural developments, which gobbled quite a huge chunk of money, almost exclusively funded through external borrowing,” Mbadi said.